CS-Cart Solution

for Ecommerce Industries

Discover the powerful features and benefits of CS-Cart, the leading e-commerce software solution.

Build Your Online Multi-Vendor Store with CS-Cart Solutions

CS-Cart is specifically designed to cater to both B2B and B2C ecommerce needs. Say goodbye to the challenges of ecommerce as our comprehensive solutions dramatically simplify the process for you.

CS-Cart Features and Benefits

– Fully customizable and feature-rich platform

– Open-source code with 2,000+ add-ons for endless possibilities

– Fast and easy launch for quick market entry

– Continuous growth for long-term success

– Flexible shopping cart for seamless transactions

– Comprehensive marketing and promotional tools for effective campaigns

– Intuitive web-based administration panel for effortless management

Solutions for Industries

Selling digital products online is a cost-effective and hassle-free solution. No need to store, package and deliver the product.

Create your customizable booking system. Efficiently manage booking & reservation. Attract vendors and offer booking services to customers.

Make charity simple and accessible for everyone via your website. Push your donation activity, tell about your campaigns and achieve big goals online.

You can build a reliable marketplace for quality groceries online and provide your customers with an exceptional shopping experience.

Build a successful apparel marketplace with customizable variations, product bundles and mobile commerce.

Find Out Whether CS-Cart Suits Your Industry and Requirements?

Cart-Power has extensive experience in the field of developing and implementing CS-Cart solutions. With a strong track record and a team of skilled professionals, we have successfully delivered numerous projects, catering to various industries and requirements. Our experience ensures that we provide reliable and effective solutions that meet the needs and expectations of our clients.

We’ll study your requirements and complete a technical specification.

Our team will research your idea, make a roadmap, and draw an NDA.

It includes preparing functional and visual design for various devices.

We develop functionality of both client and server software, integrate with any system and do SEO.

We offer hosting for your project, its scaling and promotion.

Customer Success Story

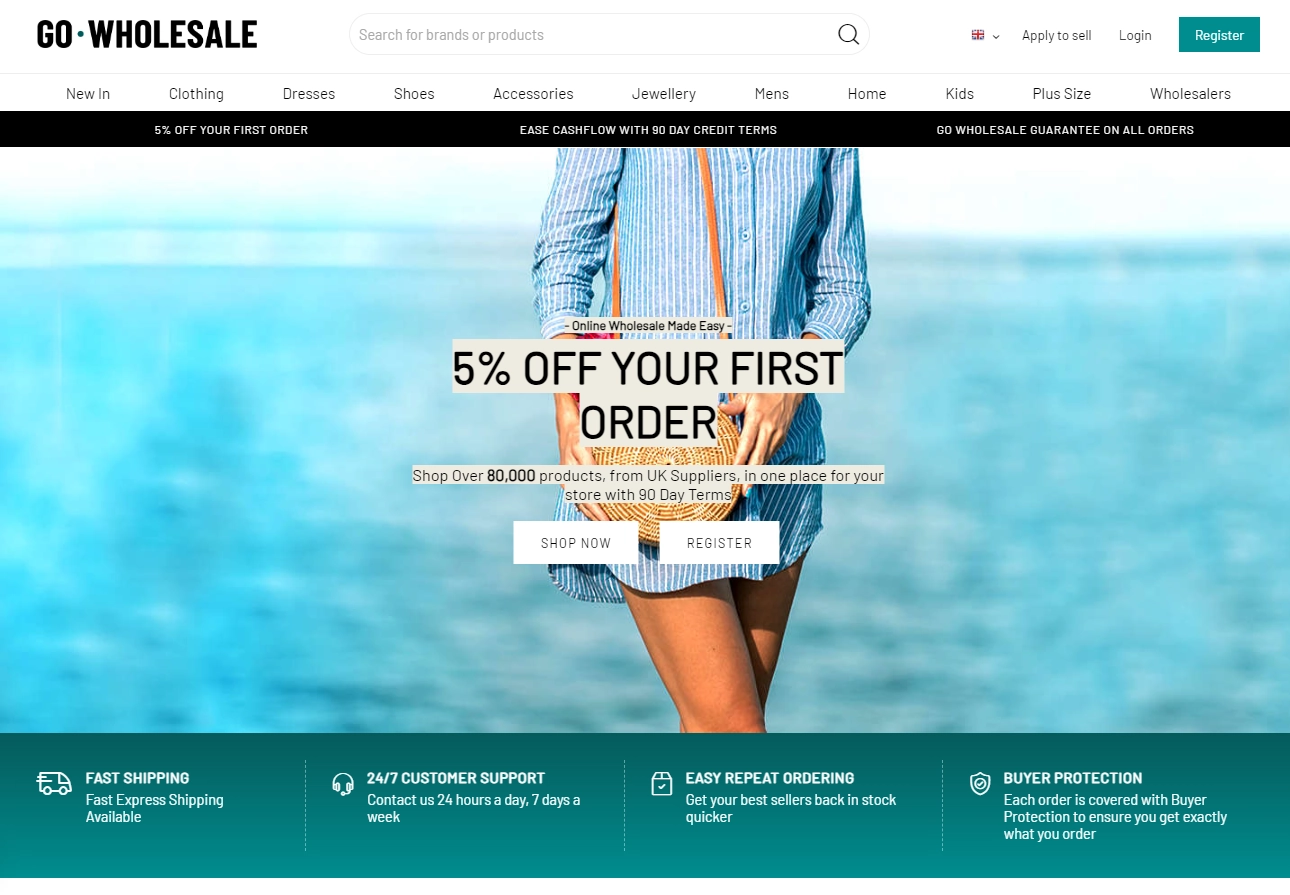

Go-Wholesale

A high-load marketplace with a wide range of products available for resellers.

Doctomarket

French marketplace of medical equipment with BNPL payment service.

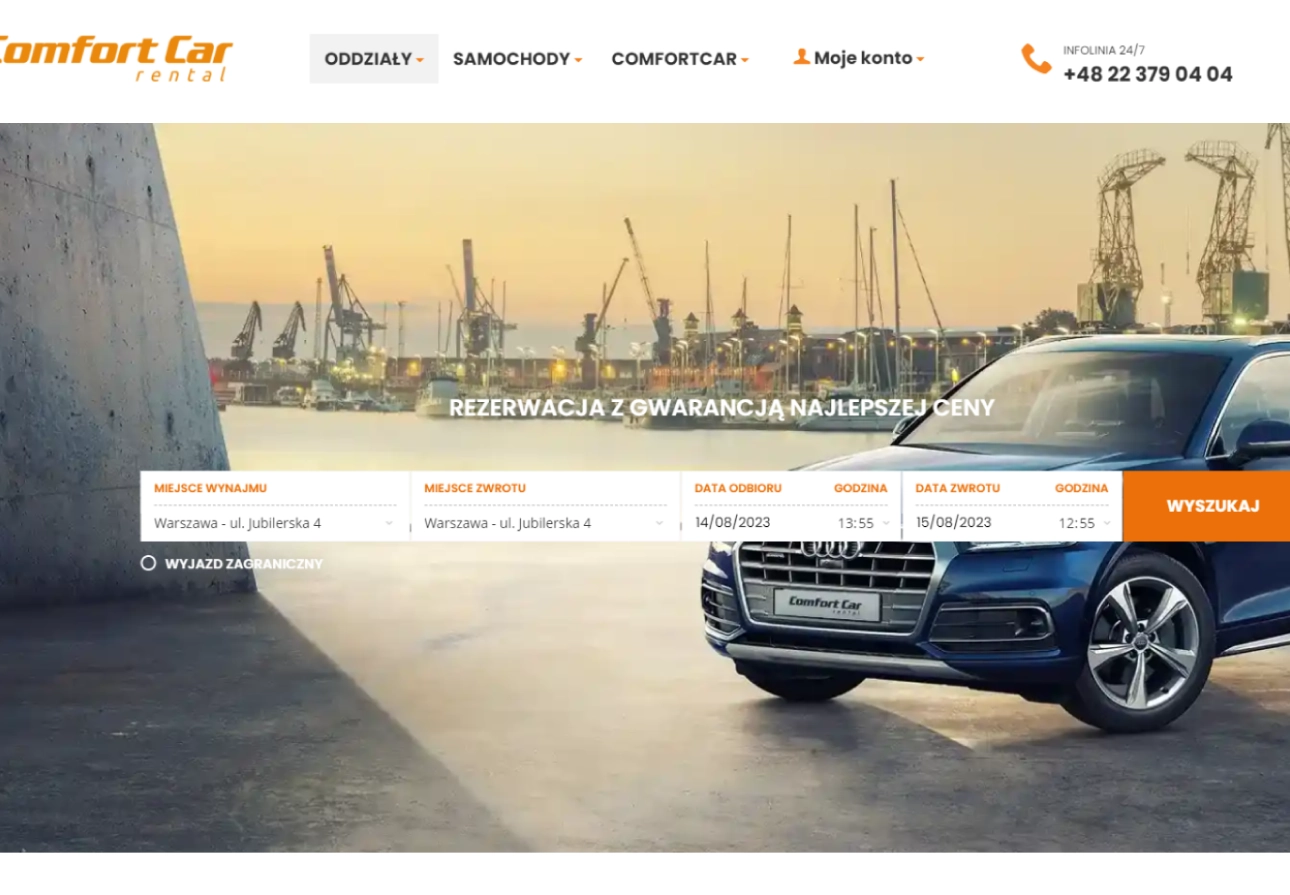

ComfortCar

Rental service in Poland where tenants can pick up the car from one city and return in another.

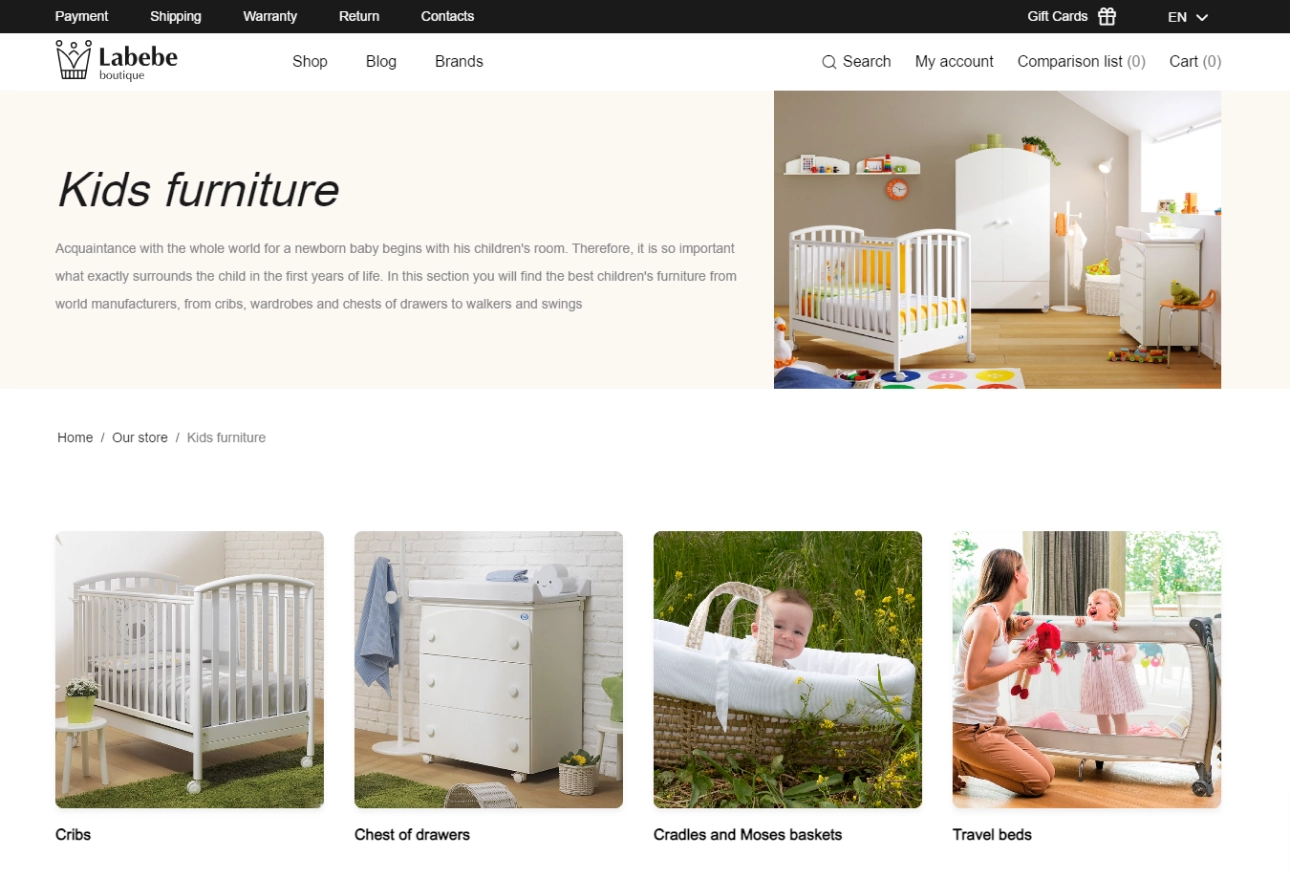

Labebe Boutique

Online store offers high quality baby products for gentle care and a safe environment.

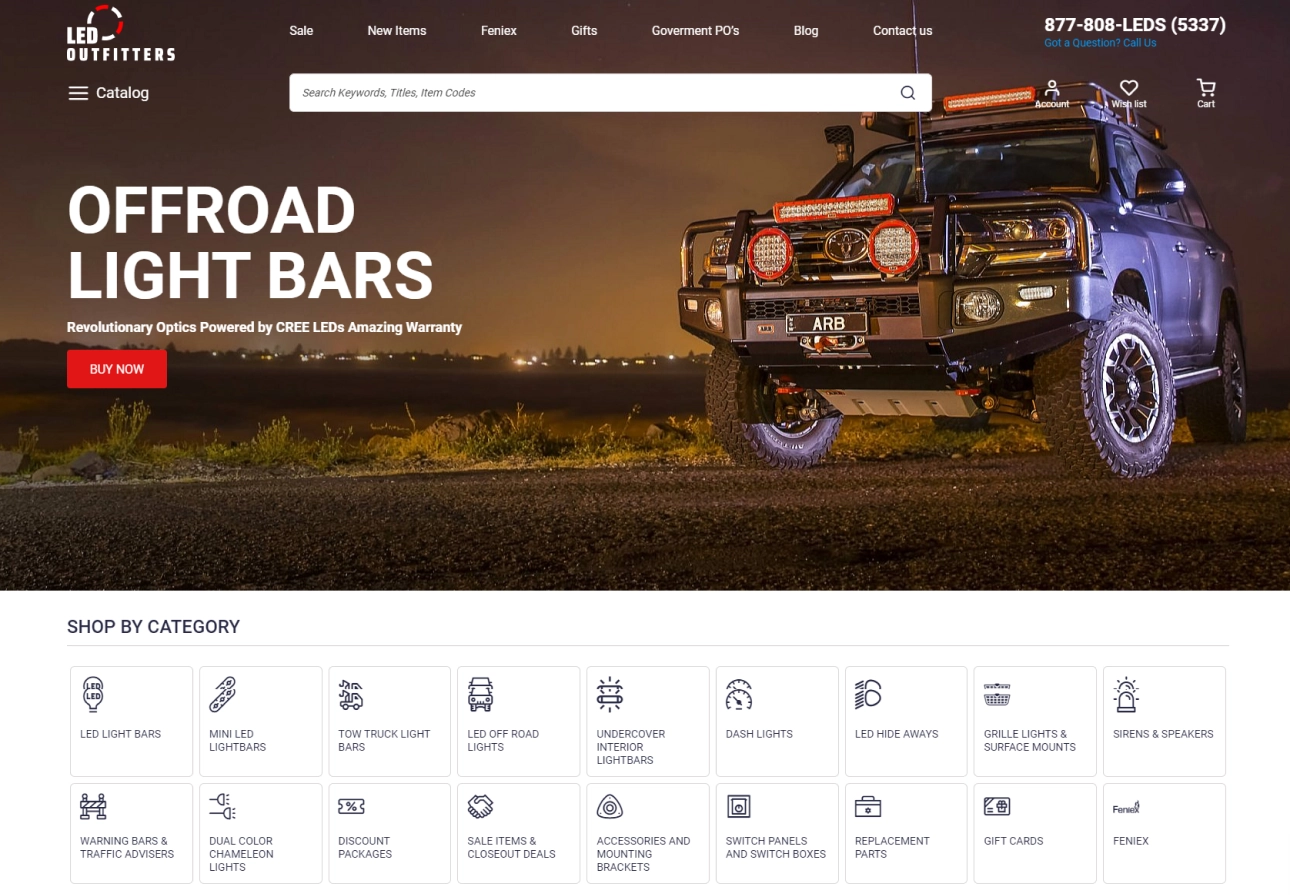

LED Outfitters

A supplier of high quality emergency lighting and special equipment for industrial and specialty vehicles

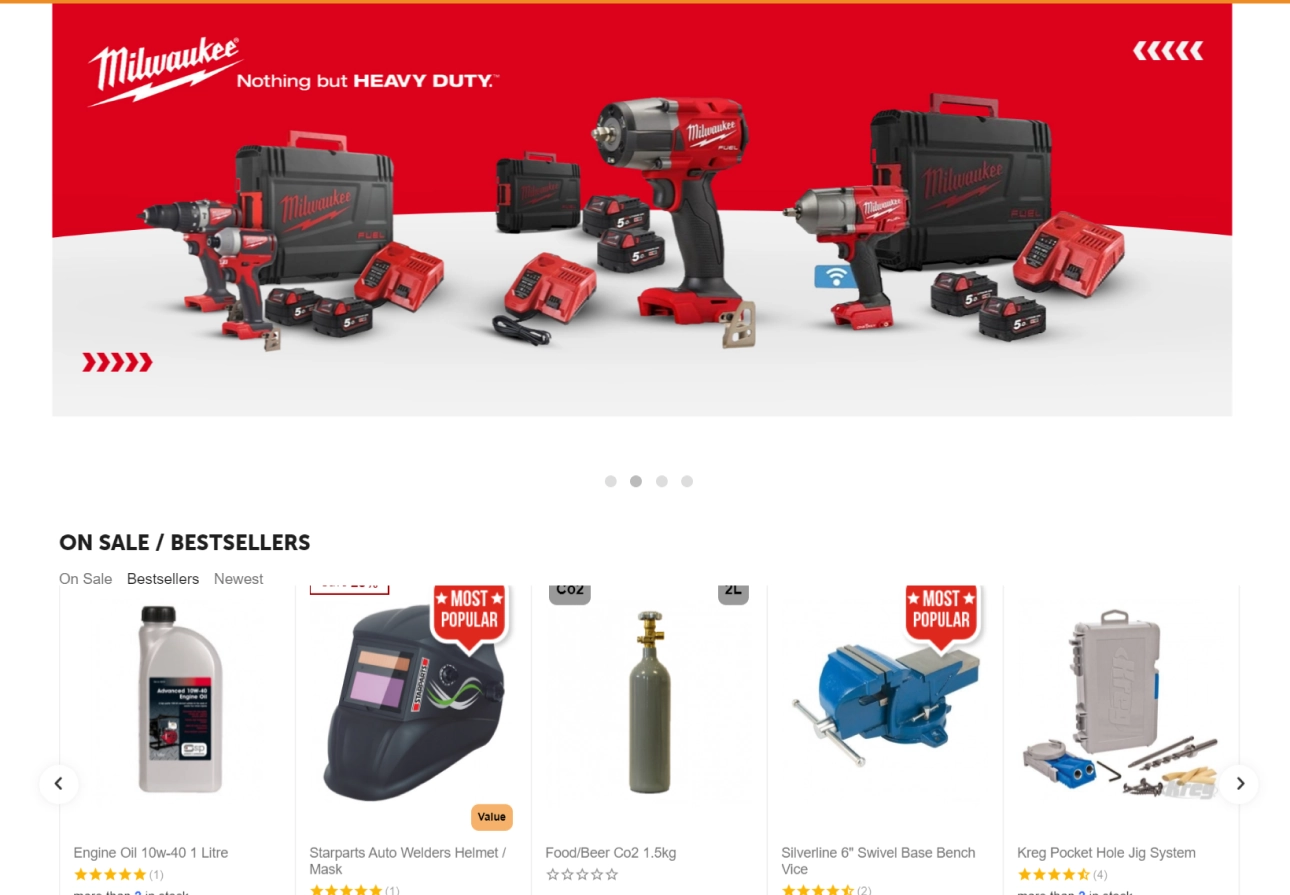

ieDepot

Ireland online store for tools and equipment

Useful Articles About Industries

- How to Build an On-Demand Service Marketplace

- Booking Marketplaces: The Future of Travel Arrangements

- Healthcare Marketplace: How to Start Selling Medical Supply & Equipment Online

- How to Start an Online Rental Marketplace

- How To Create A Nonprofit Website

- How To Start An Online Kids Store

- How To Open An Apparel Store?

- All You Need To Know To Quickly Start A Car Rental Website

- How To Make The Perfect Marketplace For Booking? Step By Step

Let’s discuss your idea

We will provide you with any help to create your project, estimate the time and the cost of your site