Online Booking Marketplace

Create your customizable booking system.

Efficiently manage booking & reservation. Attract vendors and offer booking services to customers.

Features of Booking Marketplace

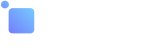

Manage Flexible Booking System

- Configure booking slots on the basis of weekdays.

- Define time slots for the bookings.

- Set dynamic prices depending on the selected day or time slots with automatic cost calculation.

- Control and manage booked services through the availability calendar.

- Setting the start and end date of a booking type product.

- Create the booking plans as per the services.

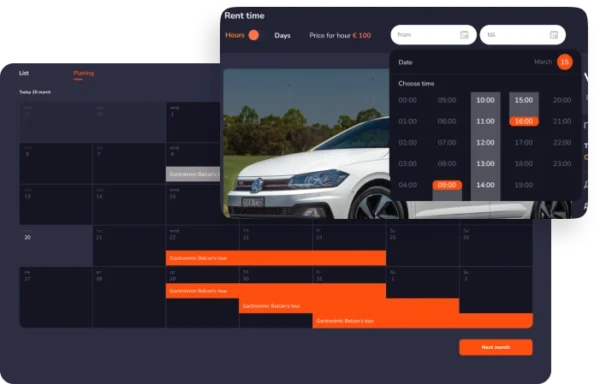

Differentiate Booking and Reservation Products

- Vendors can create a booking type product, and the admin approved/disapproved the booking products.

- Searching the booking products displayed on the map will help visitors find services in the desired geolocation.

- High-quality photos, informative description, enclosed instructions will help to remember and answer all customer questions.

- Offer additional services directly from the booking product card so that your offer is comprehensive and the average check is higher.

Booking Options for Customers

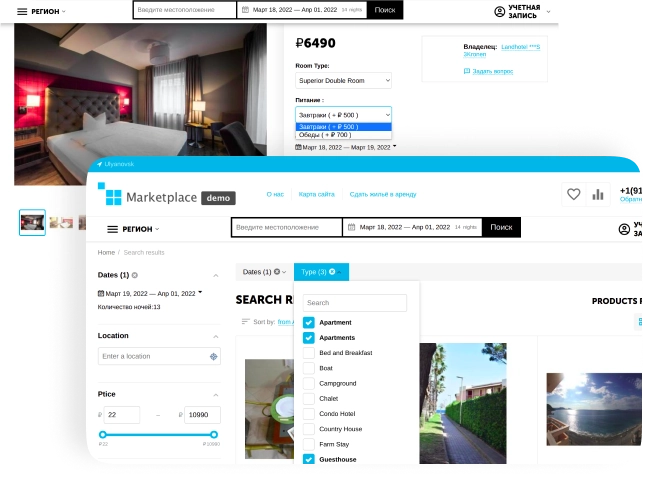

- Easily search for booking products by various filters, dates, location and price.

- Clear booking calendar with dates and time slots.

- Bonus system for building loyalty and re-booking.

- Additional information in the booking card – attach photos, mark the most useful reviews, for a quick decision.

- Estimate and view booking products of sellers approved by the administrator.

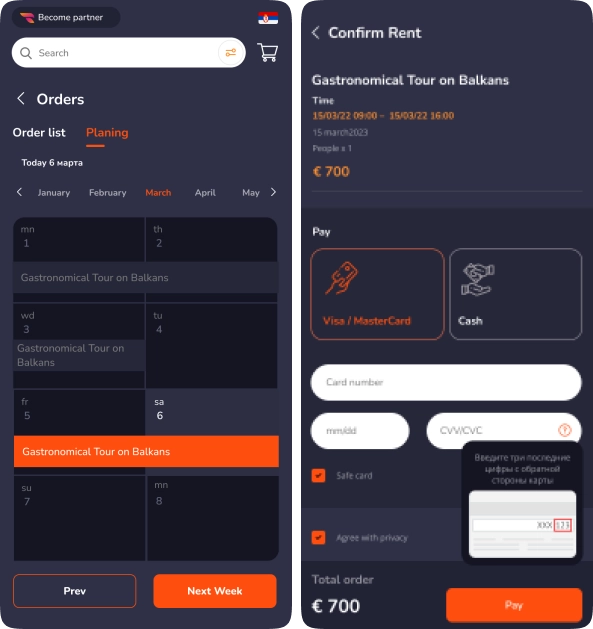

Convenience Mobile Application

76% of people use mobile devices to book online.

Create a booking service that is convenient in any place, on any device. Use the benefits of the Multi-Vendor Marketplace app for iOS and Android to stay connected providers and customers with your booking system.

Growth Capacity of Your Booking Marketplace

Work with hotels, booking services around the world, and set up your partner network. Communicate with clients in different languages, use multi currency payment systems.

Thinking of Starting Your Booking Marketplace Project?

Types of Booking Solution

Customers use the rental products by paying a fixed rental price. No need to buy a product.

Service booking marketplaces simplify the organization of events by bringing providers and attendees together on one platform.

Cafes and restaurants, medical centers, beauty&wellness centers are switching to online scheduling for effective management.

Success Stories of Booking Marketplace

Find Out More About Booking Systems

How to combine different business models on the booking marketplace? What monetization options are there? What should be in the functionality of the booking marketplace? Rean in How To Make The Perfect Marketplace For Booking? Step By Step

How does a car rental service work? What is the difference between carsharing and car rental? What are the pros and cons of the car rental service? What site structure should be? Read in All You Need To Know To Quickly Start A Car Rental Website

What products and niches to choose to create a rental site? How to make money on the rental marketplace? Must-Have functionality for rental marketplace. Read in How to Start an Online Rental Marketplace

To create a listing on a booking marketplace, you will typically need to sign up as a provider and provide relevant information about the services or experiences you offer. This may include details such as the location, availability, pricing, and any other necessary information for customers to make an informed booking. The marketplace will guide you through the process and may require you to upload photos or set specific parameters for your listing.

When a customer makes a booking through a booking marketplace, you will typically receive a notification or confirmation through the platform. It is important to respond promptly to confirm the availability and details of the booking. The marketplace may provide tools to manage your calendar and availability, as well as communicate with customers. Once the booking is confirmed, you will be responsible for providing the service or experience as agreed upon.

The costs of using a booking marketplace as a provider can vary. Some marketplaces may charge a commission fee or a percentage of each booking as their revenue model. Others may offer subscription plans or charge a fixed monthly fee. Additionally, there may be additional fees for certain features or services offered by the marketplace. It is important to review the terms and pricing structure of each booking marketplace before signing up as a provider.

Booking marketplaces usually handle the payment process on behalf of the customers and may offer various payment options, such as credit cards, debit cards, or online payment platforms. The marketplace will securely process the payment and may hold the funds until the service or experience is provided, ensuring both parties are protected. Some marketplaces may also provide cancellation policies and refund processes for customers.

Booking marketplaces often have measures in place to ensure the quality and reliability of providers. They may have review systems where customers can rate and leave feedback about their experiences with the providers. Marketplaces may also verify providers by collecting certain documents or certifications to ensure they meet specific requirements. Additionally, marketplaces may offer customer support to handle any issues or disputes that may arise during the booking process.

Let’s discuss your idea

We will provide you with any help to create your project, estimate the time and the cost of your site